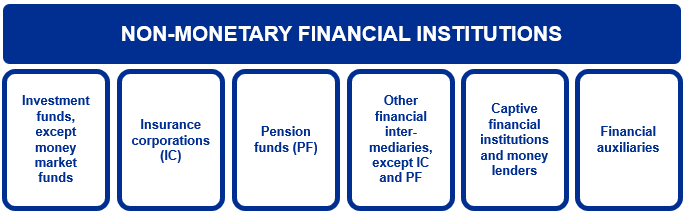

A non-monetary financial institution (non-MFI) is an entity whose main economic function is to channel or help channel funds from savings-holding entities to entities that need funds to invest, but which are not authorised to receive deposits or do not receive close substitutes for deposits.

Which entities are classified as non-monetary financial institutions?

The non-MFI sector includes a range of institutions.

- Investment funds, except money market funds are collective investment undertakings whose main function is financial intermediation. Their business is to issue investment fund shares/units not considered to be close substitutes for deposits and to invest in financial and non-financial assets (typically real estate) on their own account. In other words, an investment fund is a type of financial entity through which investors can indirectly channel their savings in order to invest in the capital market or the real estate market.

- Insurance corporations are financial institutions whose main function is to provide financial intermediation services resulting from risk pooling, particularly in the form of direct insurance or reinsurance. Direct insurance can be broken down into life insurance and non-life insurance (for example, fire insurance, civil liability insurance, motor insurance and sickness insurance). Reinsurance corresponds to risk-sharing operations between insurers. This subsector also includes mutual insurance entities which are owned by their policyholders. Social insurance, commonly referred to as “social security”, is not part of the insurance corporation subsector.

- Pension funds include all financial entities whose main function is to provide financial intermediation services aimed at risk sharing to ensure retirement, death or disability benefits. This subsector only comprises funds which are separate from the units that created them. Social security pension systems are not included.

- Other financial intermediaries except insurance corporations and pension funds include all institutions whose main function is to provide financial intermediation services by incurring liabilities in the form of loans by other financial entities or by issuing securities. This type of entity can be further broken down into:

- security and derivative dealers;

- financial corporations engaged in lending, including financial leasing companies, factoring companies and companies specialised in consumer lending;

- specialised financial corporations, including venture capital companies, import/export financing companies, and central counterparty clearing houses (i.e. not banks);

- financial vehicles engaged in securitisation transactions.

- Captive financial institutions and money lenders are neither financial intermediaries nor financial auxiliaries. This subsector includes holding companies that only hold participating interests in firms of the same group, money lenders and special-purpose entities that obtain open market funds to finance firms within the group. These holding companies hold shares or equity of a group of subsidiaries but do not provide other services to them, i.e. they do not engage in any administrative or management activity for other firms within the group.

- Financial auxiliaries are entities whose business is to facilitate financial intermediation. However, they do not handle the intermediation themselves. They include entities auxiliary to insurance (insurance brokers and mediators and risk and damage evaluators), pension fund management companies, investment fund management companies, venture capital fund management companies, credit securitisation fund management companies, wealth management companies, payment institutions, exchange offices and head offices of financial groups.

Related explainers

What is a financial instrument?

What is an institutional sector?