Institutional sectors are a category in national accounts that brings together economic agents with similar economic behaviour.

Why do we use institutional sectors?

The economy of a country can be thought of as a system whereby economic agents (institutions and people) interact by exchanging and transferring goods, services and means of payment (e.g. cash) for the production and consumption of other goods and services.

Macroeconomic analysis does not consider the actions of individual economic agents separately. Instead, it looks at the combined activities of agents with similar economic behaviour. Therefore, economic agents with similar characteristics and behaviour are grouped into the same institutional sector. Each economic agent belongs to a single institutional sector, which can be further divided into subsectors.

What are the main institutional sectors?

Institutional sectors are classified and defined by international statistical standards. The European Union uses an adapted version of the global standard – the European System of Accounts (ESA 2010).

It includes the following main sectors:

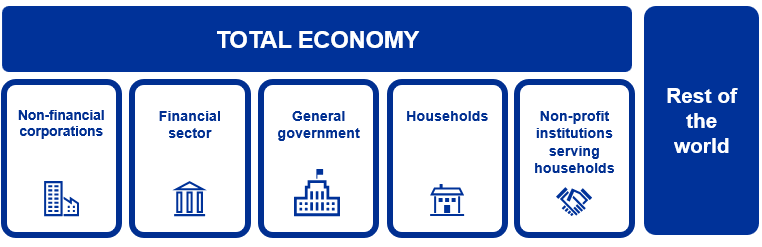

- Total economy (S1): resident institutional sectors in the economic territory of a country (S11 to S15).

- Non-financial corporations (S11): economic agents engaged in the (market) production and trade of non-financial goods and services.

- Financial sector (S12): economic agents engaged in the (market) production of financial services. It includes entities carrying out financial intermediation and entities providing auxiliary financial activities. It also includes entities providing financial services where assets or liabilities are not transacted on open markets. For the financial sector subsectors, see What is a financial institution?.

- General government (S13): institutional agents that are non-market producers and financed by compulsory payments, such as taxes, made by entities belonging to other sectors. It also includes all institutional units principally engaged in the redistribution of national income and wealth, such as social security institutions. However, entities which are controlled by governments may still be classified in the non-financial corporations sector or the financial sector. Here, the “market producer” criterion applies. The general government sector includes non-market public institutional units only.

- Households (S14): individuals or groups of individuals as consumers and as entrepreneurs. It includes individuals directly producing market goods and financial and non-financial services, including for own use, provided that the production of goods and services is not by separate entities treated as quasi-corporations (such as sole proprietors and partnerships without legal status).

- Non-profit institutions serving households (S15): private institutional units which are separate legal entities, serve households and are non-market producers. Their principal resources are voluntary contributions from households and from payments made by general governments. Examples include trade unions, churches, sports clubs, political parties and charities.

The households (S14) and non-profit institutions serving households (S15) sectors are often regrouped into a single sector (S1M). - Rest of the world (S2): non-resident units in the economic territory of a country insofar as they engage in transactions with resident institutional units or have other economic links with resident units.

Related explainers

What is a financial institution?