Financial instruments are financial assets and liabilities which are held by economic agents or generated in financial operations.

Why do we categorise financial instruments?

Categorising financial instruments provides more structured information on the financial assets and liabilities of the various institutional sectors. It also supports the analysis of a sector’s financial behaviour, for example, the type of instruments its savings are channelled into, its maturity preferences, and its sources of funding.

What financial instruments are there?

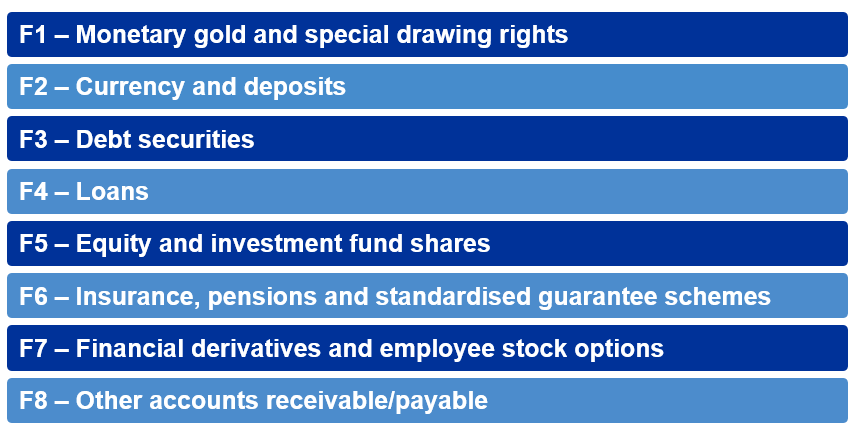

Financial instruments are classified and defined according to international standards. There are eight categories. Each category can also be further broken down according to different characteristics, such as maturity (e.g. short-term or long-term).

Financial instruments are mostly classified according to their liquidity, negotiability and legal characteristics. The eight categories of financial instrument are as follows.

Monetary gold and special drawing rights (F1): monetary gold is gold to which monetary authorities have title. It includes gold bullion and unallocated gold accounts. All gold held by other entities is considered non-monetary gold and is not classified as a financial instrument. Unlike all other instruments, gold bullion can only be recorded as a financial asset (i.e. never as a liability). Special drawing rights (SDRs) are international reserve assets created by the International Monetary Fund (IMF). SDRs can be converted into any IMF member country currency and serve as a source of liquidity for those countries.

Currency and deposits (F2): banknotes and coins in circulation, as well as transferable deposits (which are exchangeable for currency on demand or easily transferable) and other deposits (which are not exchangeable for currency without some restrictions and cannot be used to make instant payments).

Debt securities (F3): negotiable financial instruments serving as evidence of debt. Securities have the following main characteristics:

- face value: debt value to be paid at maturity;

- maturity: date on which the security matures;

- coupon: some securities pay a coupon at certain intervals.

In view of these (and other) characteristics, this instrument comprises several types of debt securities which can be distinguished by their maturity (short, medium and long-term) or by their coupon payments (or lack thereof), among other things. Securities can also be grouped in terms of issuer. For example, securities issued by the general government are usually called government debt securities.

Loans (F4): contracts through which a creditor provides funds to a debtor, and the debtor undertakes to repay that amount (plus interest) within a specified period.

Equity and investment fund shares or units (F5): securities issued by a given entity, representing a set of investor rights on the issuer. The best-known form of equity are shares, which usually represent a portion of an entity’s equity capital. Shares can be listed or unlisted.

This instrument also includes investment fund shares or units, which are instruments issued by an investment fund that represent a claim over a portion of that fund.

Insurance, pension and standardised guarantee schemes (F6) cover:

- non-life insurance technical reserves: claims that non-life insurance policy holders have against non-life insurance corporations in respect of unearned premiums and claims incurred;

- life insurance and pension entitlements: claims that life insurance policy holders and pension beneficiaries have against corporations providing life insurance;

- provisions for calls under standardised guarantees: claims that holders of these guarantees have against the entity providing them.

Contingent pension entitlements as liabilities of the general government or its subsectors are not covered and are not included as financial assets of the beneficiaries.

Financial derivatives and employee stock options (F7): a financial derivative is an instrument issued on the basis of the value of a different asset or an indicator, known as an underlying asset or indicator. It may be a share, commodity, interest rate, exchange rate or bond, etc. Therefore, the value of the derivative depends on the value of that asset. This type of instrument is commonly used to manage risks (e.g. the risk of a rise in commodity prices or interest rates) or as a form of speculation.

Other accounts receivable/payable (F8): these financial assets or liabilities arise when there is a timing difference between the financial transaction and the corresponding payment or receipt. For instance, a supplier who sells a product to a corporation, but only receives the due payment later, will have a credit (in this case a trade credit) on that corporation from the time of sale until actual payment.

Are financial assets and liabilities classified under the same financial instrument?

Yes. Here are some examples:

- When a private individual places a deposit with a bank, that deposit is regarded as a financial asset of the individual and a liability of the bank.

- When a corporation issues bonds that are purchased by investment funds from other countries, these debt securities are considered a liability of the corporation that issued them and a financial asset of the funds that purchased them.

- When a bank lends money to an entity belonging to the general government sector, that loan is an asset of the bank and a liability of the entity belonging to the general government.

The only exception is gold bullion, which can only be recorded as a financial asset.