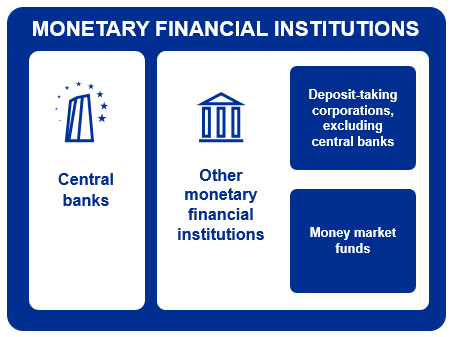

Monetary financial institutions (MFIs) include central banks and other monetary financial institutions (OMFIs). The latter comprises deposit-taking corporations other than central banks (commonly referred to as “banks”) and money market funds.

The principal function of central banks is to issue currency, maintain the internal and external value of the currency and manage all or part of the international reserves of the country. In the euro area, these functions are carried out by the Eurosystem, which comprises the ECB and the national central banks of euro area countries.

Banks are the main financial intermediaries in the euro area. Their business consists of receiving deposits or other reimbursable funds from the public and investing those funds at their own risk by granting credit in the form of loans or by purchasing debt securities issued by other entities.

Most of these entities are counterparties for central bank monetary policy operations. By granting credit to households and corporations, especially when using credit received from the central bank, they are crucial for the transmission of monetary policy impulses to the economy.

Money market funds are collective investment undertakings that issue units which, in terms of liquidity, are close substitutes for deposits. They primarily invest in money market instruments, bank deposits and other debt securities with a residual maturity of up to and including one year.

Money market funds account for around 5% of the total assets of the euro area OMFI sector.

Related explainers

What is a financial institution?