Financial vehicle corporations are financial institutions that can carry out securitisation operations. Alternative names for such entities include “special-purpose vehicles” or “securitisation special-purpose entities”.

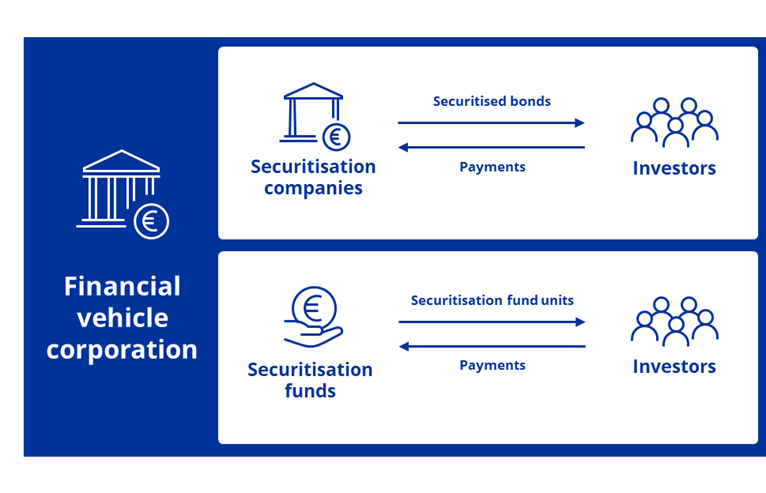

Financial vehicle corporations can take various legal forms. In terms of financing, they can be classified into two main types: securitisation companies and securitisation funds.

Securitisation companies can issue asset-backed securities to fund the purchase of assets. They can carry out a single securitisation operation (closed entities) or several simultaneous securitisation operations (open entities).

Securitisation funds (which, like investment funds, are independent entities) issue securitisation fund units to finance the purchase of assets. These fund units are usually created to carry out a single securitisation operation only, making them closed entities.

What are securitisation operations for?

For the originator, traditional securitisation operations are a way of obtaining liquidity. Moreover, by pooling and thus diversifying the risks of a portfolio of assets, securitisation allows the originator to transfer the aggregate risk to different investors with a range of risk appetites. Securitisations can also have a positive impact on capital ratios and can help bridge the asset/liability maturity gap, while offering a way of diversifying funding sources.

Related explainers