Put simply, interest is “the cost of money”.

Interest is what it costs you to borrow money, and what you earn from the money you save. In other words, if you borrow money from a bank, the interest is what you pay for your loan. Meanwhile, when you put your money in a savings account or make a deposit, interest is the return you receive on your savings.

This cost or return is expressed as a percentage of the amount borrowed or lent, with reference to a given period.

Bank loan and deposit contracts have different maturities, and customers can invest in inflation-protected instruments. Interest rates can be nominal or real, simple or compound, fixed or variable and gross or net. There is also the annual nominal rate and, specifically for mortgages, the annual percentage rate of charge. In addition to interest rates on loans and deposits, there are also what are known as “yields” on debt securities (e.g. government bonds).

Who sets interest rates?

The market

The level of interest rates is primarily determined by the market. More precisely, interest rates depend on the supply and demand for loans and savings. When savings are plentiful or when there is little demand for loans, interest rates are usually low. Conversely, if demand for loans increases, interest rates tend to go up.

Central banks

In addition to the market, interest rates are also influenced by central banks. The Governing Council of the ECB sets the key interest rates for the euro area. One of the most important of these is the rate on the deposit facility, which is used by banks to make overnight deposits with the Eurosystem. This rate is pre-set and serves as the ECB’s main policy tool, signalling its monetary policy stance. The central bank typically controls the short-term interest rate and thus influences the yield curve, which is then determined by market forces.

Through the monetary policy transmission mechanism, the ECB’s key policy rates affect the interest rates paid by consumers and businesses. So, the key policy rates set by the ECB affect the interest rates on your savings account, the cost of your mortgage and the interest your business pays on a loan.

Generally speaking, the interest you pay is a lot higher than the key policy rates set by the ECB. In the case of mortgages, for example, banks also factor in their own costs. And, of course, they hope to make a profit on the loan. In addition, banks charge a little extra in the form of a risk premium, to cover defaults by borrowers who can no longer repay the loan.

Want to learn more?

If you dig deeper into the subject of interest rates, you’ll come across various different concepts and types of interest. Here are some of the most important ones!

Short-term or money market interest rates

The interest rate on short-term loans (loans with a term of up to one year) in the money market. The shortest term is one day. This overnight interest rate tends to closely align with the ECB’s key policy rate.

Long-term or capital market interest rates

The interest rate on long-term euro-denominated government bonds (e.g. a 10-year government bond). The long-term rate is usually, but not always, higher than its short-term equivalent. When it’s lower, we call this an “inverted yield curve”.

Long-term interest rates largely mirror market participants’ expectations of what central banks will do with interest rates down the road, and of how inflation and economic growth are likely to perform.

Real and nominal interest rates

The nominal rate of interest is the rate agreed on and paid. For example, it’s the rate homeowners pay on their mortgages, or the return savers get from their deposits. Borrowers pay the nominal rate, while savers earn it.

But this nominal amount is not the only thing that matters to borrowers and savers. They also care about purchasing power – the goods, services and other items their money can buy. It tends to decline over time as prices rise owing to inflation. By accounting for inflation, we can see the real cost of borrowing and the real return on savings.

The formula for calculating the real interest rate is:

Real interest rate = nominal interest rate - inflation

Key policy rates

The ECB sets three key interest rates every six weeks as part of its work to keep prices stable in the euro area. One of these is the rate on the main refinancing operations, which is the interest banks pay when they borrow money from the ECB for one week. When they do this, they have to provide collateral as a guarantee that the Eurosystem will receive the amount lent even if the bank does not repay the money borrowed.

There’s also the rate on the marginal lending facility, which is the rate at which banks can borrow from the ECB overnight against broad collateral at a pre-set interest rate. This costs them more than if they borrow for one week. Finally, we have the rate on the deposit facility, which determines the interest banks receive – or have to pay when interest rates are negative – for depositing money with the ECB overnight. This rate is the ECB’s primary signalling tool, and the Governing Council can adjust it to steer the monetary policy stance.

What are bank interest rate statistics?

The ECB publishes interest rate statistics every month.

Bank interest rate statistics consist of data on the interest rates that euro area banks charge or pay on euro-denominated deposits and loans to resident households and firms within the euro area. These harmonised statistics are used to analyse monetary developments and the monetary transmission mechanism, as well as to monitor financial stability. Thanks to interest rate statistics, we can assess how well the monetary policy transmission mechanism is working.

The ECB provides interest rate statistics on both outstanding amounts and new business. The first group covers the interest rates on outstanding deposits with an agreed maturity and on the outstanding loans recorded on banks’ balance sheets at the end of each month. Meanwhile, statistics on new business covers the interest rates charged or paid on new loan and deposit contracts agreed between customers and their banks over the course of a month.

The ECB and the euro area national central banks publish information on the amounts and the respective weighted average rates charged or paid, i.e. the annualised agreed rate (AAR) and the annual percentage rate of charge (APRC).

What are the AAR and the APRC?

The AAR is the interest rate individually agreed on by a bank and its customers. It can sometimes diverge from the advertised rates, as households and businesses may be able to negotiate better terms and conditions than those advertised. Bank interest rates are converted to an annual basis and expressed as an annual percentage.

The APRC is the effective lending rate, which represents the total cost of a loan to the consumer. In addition to the interest rate, it includes other charges like insurance and fees.

What does “new business” mean in the context of interest rate statistics?

New business means:

- any financial contract that specifies the interest rate on a deposit or loan for the first time;

- any existing deposit or loan that has been renegotiated.

Existing deposit and loan contracts that are renewed automatically – i.e. without the active involvement of the customer and without any renegotiation of the terms and conditions of the contract, including the interest rate – are not considered new business. Bank interest rate statistics on new business thus reflect the supply and demand conditions in the deposit and loan markets at the time of the contract, taking into account competition with other types of financial institutions and products. Interest charged on bad loans or on loans for debt restructuring granted at below-market conditions is not included in these statistics.

What statistics are available?

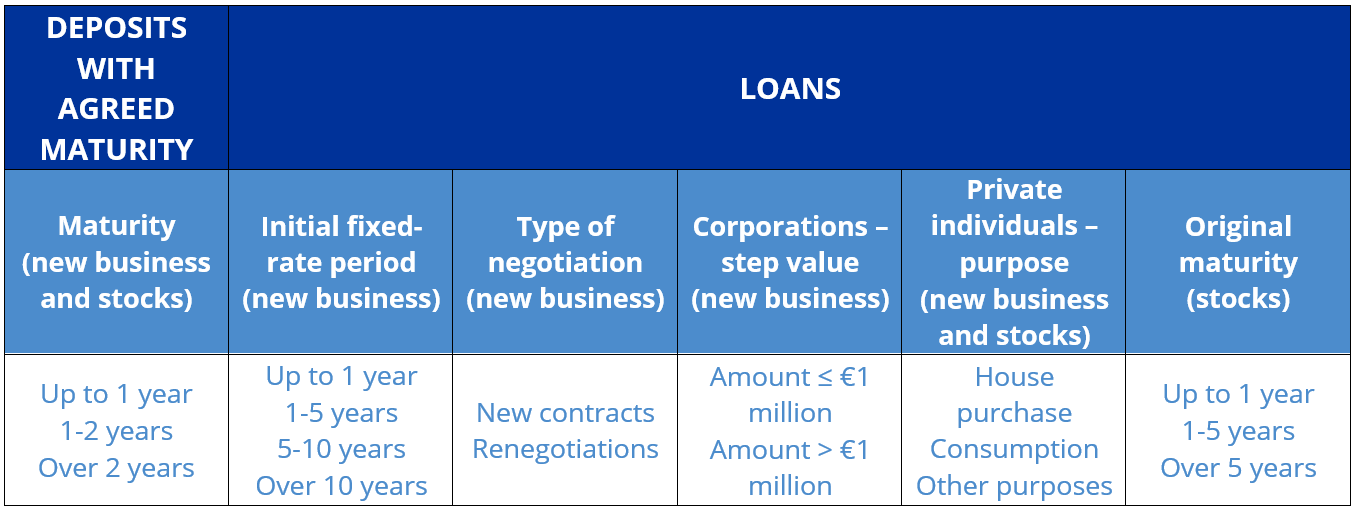

The ECB publishes monthly statistics on the amounts and the average interest rates euro area banks charge or pay. The information available is broken down as follows: